private retirement scheme tax relief

Saving in a pension doesnt affect your benefit entitlement. 301116 was a form of the poll tax.

Private Retirement Scheme Prospectus Analysis Cf Lieu

If your employer operates salary sacrifice for pension contributions you get national insurance relief as well as tax relief.

. The CIS is a HMRC scheme which applies if you work for a contractor in the construction industry but not as an employee so for example as a self-employed individual. Pensions property and more. Exhibitionist Voyeur 052221.

Saving in a LISA does. The Troubled Asset Relief Program TARP is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George BushIt was a component of the governments measures in 2009 to address the subprime mortgage crisis. This relief gives a CGT rate of 10 on gains from the disposal of qualifying business assets.

The Supplementary Retirement Scheme SRS is a voluntary scheme to encourage individuals to save for retirement over and above their CPF savings. Latest news expert advice and information on money. Get all of the latest Business news from The Scotsman.

So for the entire 202122 tax year the total work from home tax relief would be around 62 for basic rate taxpayers or around 124 a year for higher rate taxpayers assuming the 6 a week. There is a fee for seeing pages and other features. The EPF is intended to help employees from the private sector save a fraction of their salary in a lifetime banking scheme to be used primarily as a retirement fund but also in.

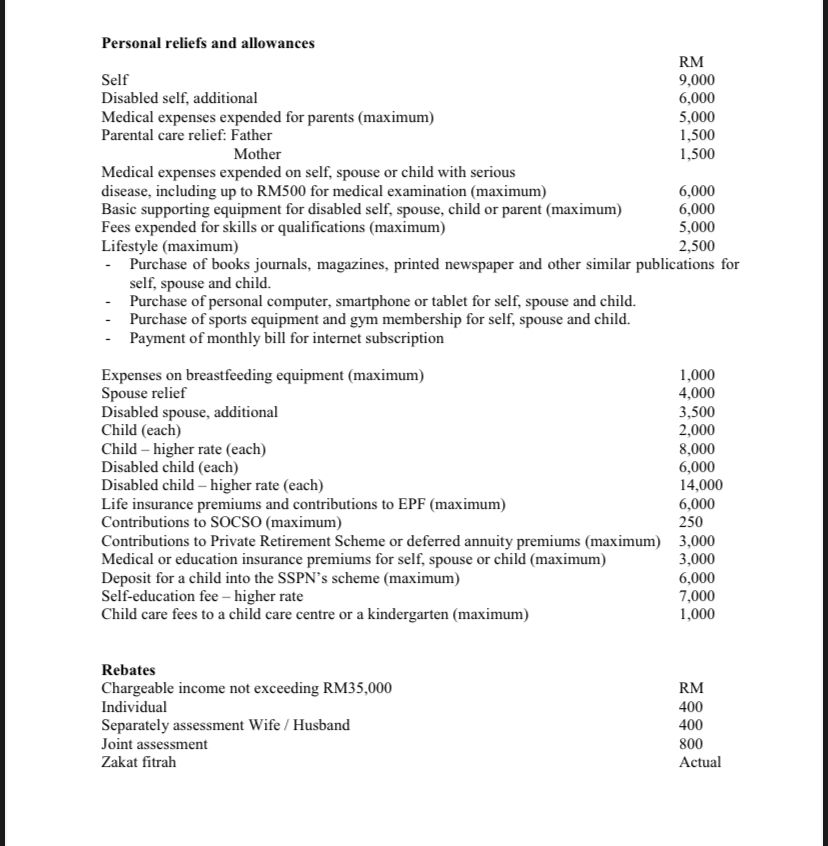

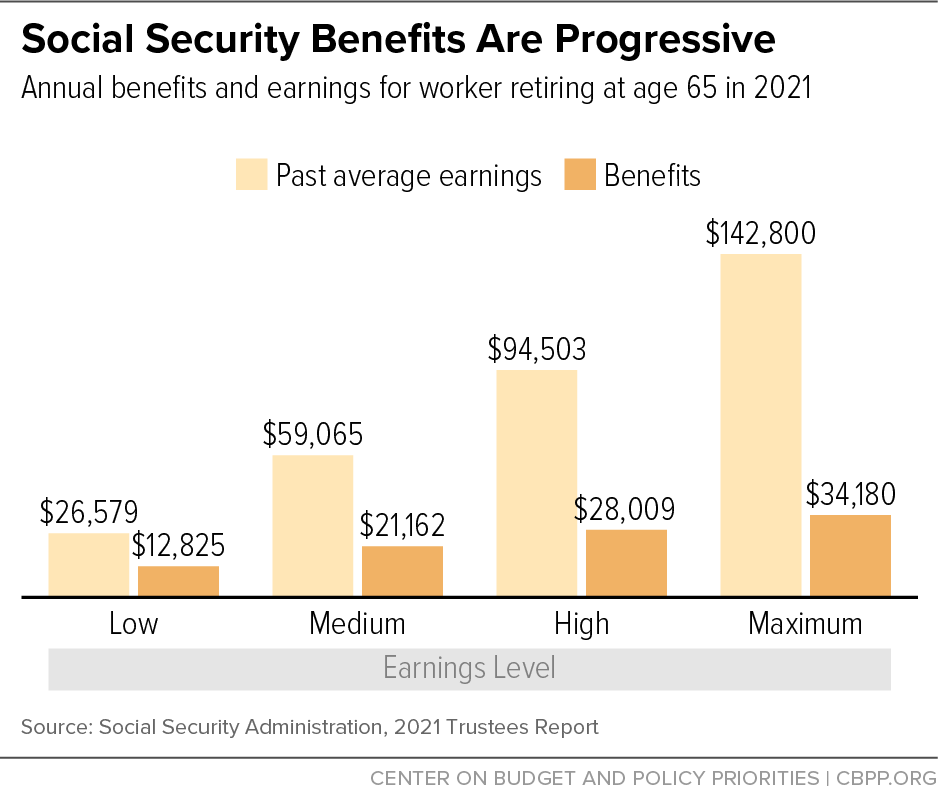

Are you in a private sector defined benefit pension scheme or a funded public sector scheme. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration SSA. Tax you pay and tax relief you get on contributions to your private pension - annual allowance lifetime allowance apply for individual protection.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Investment returns are tax-free before withdrawal and only 50 of the withdrawals from SRS are taxable at retirement. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000.

Starting from Scratch Ep. One of the earliest taxes mentioned in the Bible of a half-shekel per annum from each adult Jew Ex. Contributions to SRS are eligible for tax relief.

Exhibitionist Voyeur 051221. Tax you pay and tax relief you get on contributions to your private pension - annual allowance lifetime allowance apply for individual protection Tax on your private pension contributions. Then you can transfer to a defined contribution pension as long as youre not.

Starting from Scratch Ep. Papers from more than 30 days ago are available all the way back to 1881. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance.

Those smiles off your faces that is. News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs. Must contain at least 4 different symbols.

The Economic Growth and Tax Relief. You put 15000 into a private pension. Qualifying Conditions for Tax Exemption Scheme for New Start-Up Companies.

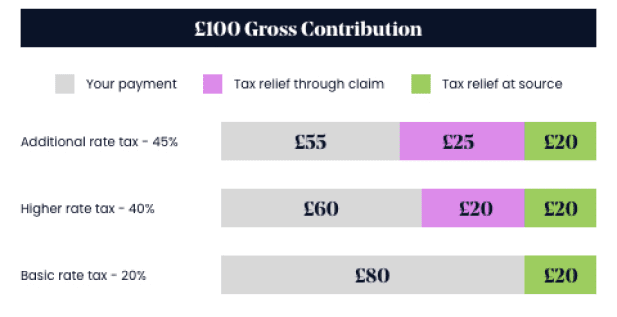

You automatically get tax relief at source on the full 15000. It is an example of the concept of fixed tax. ASCII characters only characters found on a standard US keyboard.

If youre a higher-rate 40 taxpayer you can also claim extra tax relief of up to 500 through your self-assessment tax return and up to an extra 625 if youre an. URINE IDIOT 454 Pissed on. Idiots at every turn.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. 6 to 30 characters long. Tax and pensions Tax allowances tax paid on pensions tax relief.

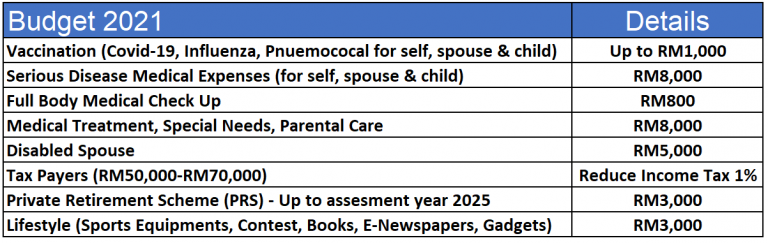

A poll tax also called a per capita tax or capitation tax is a tax that levies a set amount per individual. Which can be administered as a Self-Directed 401k permitting investment in real estate mortgage notes tax liens private. For example if you contribute a lump sum of 2000 into your SIPP youll get tax relief of 500 from the government so a total of 2500 is invested in the SIPP.

This is reduced from the normal rate of 33. FLUSH MOB 490 Dont forget to wipe Assholes. This relief replaced the Entrepreneur Relief that applied for the years 2014 and 2015.

Poll taxes are administratively cheap because. So to contribute 100 only costs them 60 easily beating a LISA. 100 of your earnings in a year - this is the limit on tax relief you get 40000 a year - check your annual allowance 1073100 in your lifetime - this is the lifetime allowance.

Providing fresh perspective online for news across the UK. The CIS rules mean that the contractor is usually obliged to withhold tax on its payments to you at either 20 if you are registered or 30 if you are not. The loan is secured on the borrowers property through a process.

Companies whose principal activity are that of investment holding. Keep reading by creating a free account or signing in. Tessa Dakotas scheme to use Henry as a practice dummy.

Higher-rate taxpayers get tax relief at 40 in a pension. The rate is 20 for disposals from 1 January to 31 December 2016. Revised Entrepreneur Relief.

View examples PDF 57KB on how to compute the amount of tax exemption under the tax exemption scheme for new start-up companies. What your pension might be if you stay in the scheme until normal retirement age usually 65. All new start-up companies are eligible for the tax exemption scheme except.

Prs Malaysia 2019 Review Should You Really Invest

Tax Relief On Pension Contributions St James S Place

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

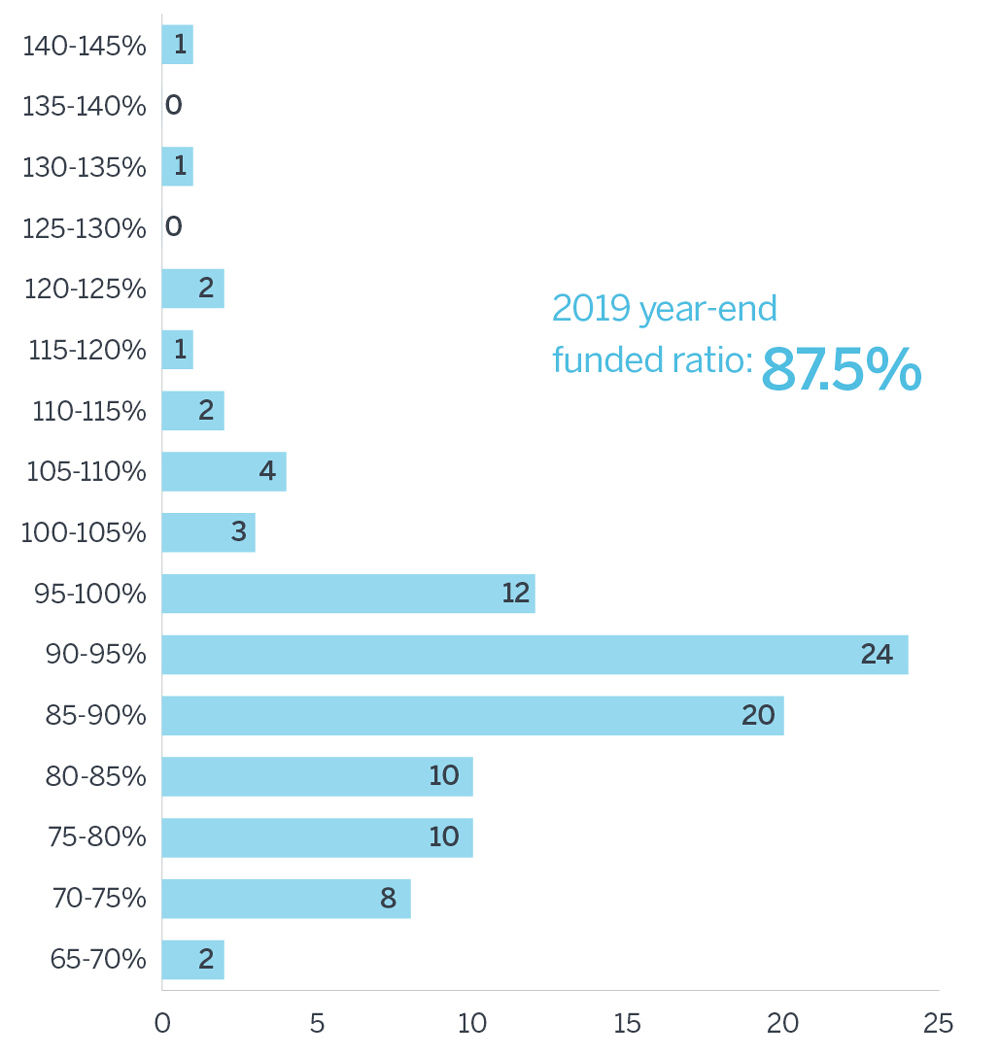

2020 Corporate Pension Funding Study

How Can Budget 2021 Benefit Malaysian Black Belt Millionaire

Rm3k Private Retirement Scheme Tax Relief Extended Till 2025 The Star

Do You Know How Tax Relief On Your Pension Contributions Works Low Incomes Tax Reform Group

Is Mortgage Insurance Tax Deductible Bankrate

Finance Malaysia Blogspot What Are The Tax Benefits From Private Retirement Scheme Prs

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Prs Tax Relief Save For Retirement And Save On Your Taxes Prs Live

Private Retirement Scheme Prs Public Mutual Berhad

Aiaprs Instagram Posts Photos And Videos Picuki Com

3 Places To Get Prs In Malaysia With Zero Sales Charge Ringgit Oh Ringgit

0 Response to "private retirement scheme tax relief"

Post a Comment